Extension Foundation Online Campus

Health

Glycan glycosylation

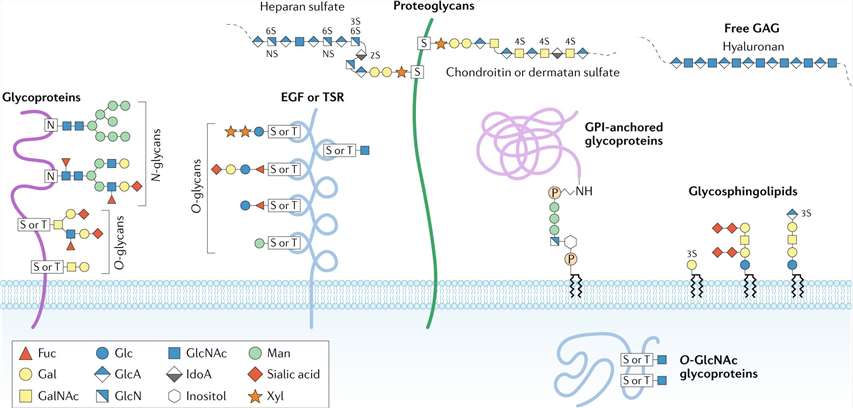

Protein is the executor of life activities. During the study of protein, researchers find that there are many modifications of the protein. Among these modifications, glycosylation modification is quite common, and more than 50% of the proteins found so far have glycosylation modification. Glycan is the sugar part of glycoprotein, including a sugar base and various types of branched structure, which is composed by various sugars such as glucose, galactose, mannose and rhamnose. The glycan is connected to the protein through oxygen on specific amino acid residues to complete the glycosylation modification of the protein.

Major types of glycosylation in humans (Reily et al., 2019).

Glycosylation in physiological processes

Glycosylation exists in many important proteins in life activities, including chromatin protein, nucleoporin, RNA polymerase II, transcription factor, protein translation regulator, etc., which involves cellular immunity and protein translation regulation, protein degradation and many other biological processes. For example, MHC I (major histocompatibility complex class I) needs to interact with the endoplasmic reticulum molecular chaperone Clx (calnexin) through the help of the glycan connected to the asparagine residue, thereby completing the binding with the dithiol oxidase ERp57 captured by Clx, complete the disulfide bond formation. Another example is the protein glycosylated by O-GlcNAc will prevent its own phosphorylation, turing it to a relatively stable state, prevent the protein from degradation.

Glycosylation occurring in diseases

Abnormal glycosylation has strong relationship with the disease. For example, in type II diabetes, hyperglycemia can lead to abnormal modification of O-GlcNAc, resulting in reduced sensitivity of cells to signals, reduced insulin receptor substrates, and the inability of insulin to use large amounts of glucose. The first disease that was confirmed to be related to glycosylation was I-cell disease, and the pathogenic mechanism was that the N-sugar chain could not be further modified with mannose-6-phosphate, makes protein catabolism disordered and cause storage disease. Similarly, for diseases caused by abnormal glycosylation, some inhibitors for glycosylation have been used in disease treatment research. Inhibitors such as α-glucosidase are used in clinical trials of diabetes; N-butyl-1-deoxynojirimycin and O-butyl-1-deoxynojirimycin are used in clinical trials of HIV.

Glycosylation type and modification mechanism

O-glycosylation: This type of glycosylation occurs on the residues of serine or threonine adjacent to proline, and no specific glycosylation sequence has been found yet. Such glycosylation is mostly oligosaccharides formed by gradually adding monosaccharides, and there are also cases where only monosaccharides are linked. Glycan formed by O-glycosylation has no sugar base, has a main bone with one or no branch.

N-glycosylation: This type of glycosylation occurs on the amide nitrogen of the asparagine side chain. Almost all such glycosylation modifications in animal cells are GlcNAc, and all are in β configuration. Such glycosylation exists on the amino acid sequence of Asn-Xaa-Ser / Thr / Cys, where Xaa can be any amino acid except Pro. Glycan formed by N-glycosylation has a sugar base, with multiple branches.

C-glycosylation: this type of glycosylation is rare, it is a molecule of mannose connected to the C of the 2nd position of the tryptophan indole ring through the C-C bond, and it mostly occurs in the first tryptophan residue of W-X-X-W-W-X-X-C or W-X-X-F.

Research methods for glycoprotein

| Method | Technology | Result |

|---|---|---|

| Glycosyl Capture | Agglutination of glycoproteins by lectins that can specifically recognize one sugar or multiple sugars. | Crude glycoprotein. |

| Fluorescent Dyes | Use fluorescent dyes to stain proteins, usually in combination with high-throughput two-dimensional gel electrophoresis. | Protein discovery and identification. |

| Liquid Chromatography | Separate glycoproteins by SEC-HILIC-CapLC workflow and other technologies. | Construct a three-dimensional liquid-phase sugar spectrum to obtain glycan structure information. |

| Mass Spectrometry | Analysis of the breaking rule of protein skeleton and sugar skeleton through mass spectrometry. | Glycosylation site analysis. |

| MRI | Accurately calculate information such as composition, ring size, and anomeric carbon conformation through changes in atomic energy transitions. | Accurately confirm the sugar chain structure. |

References

- Turroni F, et al. Glycan Utilization and Cross-Feeding Activities by Bifidobacteria. Trends in Microbiology, 2018, 26(4).

- Lindsay C, et al. Zn-α2-glycoprotein, an MHC Class I-Related Glycoprotein Regulator of Adipose Tissues: Modification or Abrogation of Ligand Binding by Site-Directed Mutagenesis. biochemistry, 2006, 45(7).

- Winters M P, et al. Discovery of N-Arylpyrroles as Agonists of GPR120 for the Treatment of Type II Diabetes. Bioorganic & Medicinal Chemistry Letters, 2018, 28(5).

- Li S, Yi L, et al. O-Glycosylation of EGF repeats: identification and initial characterization of a, UDP-glucose: protein O-glucosyltransferase. Glycobiology, 2002, 1(11).

- Priola S A, et al. Glycosylation influences cross-species formation of protease-resistant prion protein. embo journal, 2001, 20(23).

- Reily, Colin, et al. "Glycosylation in health and disease." Nature Reviews Nephrology 15.6 (2019): 346-366.

Read More:

ptm analysis